Open Platform Monetization - Leveraging Other People's Money

the power of leverage

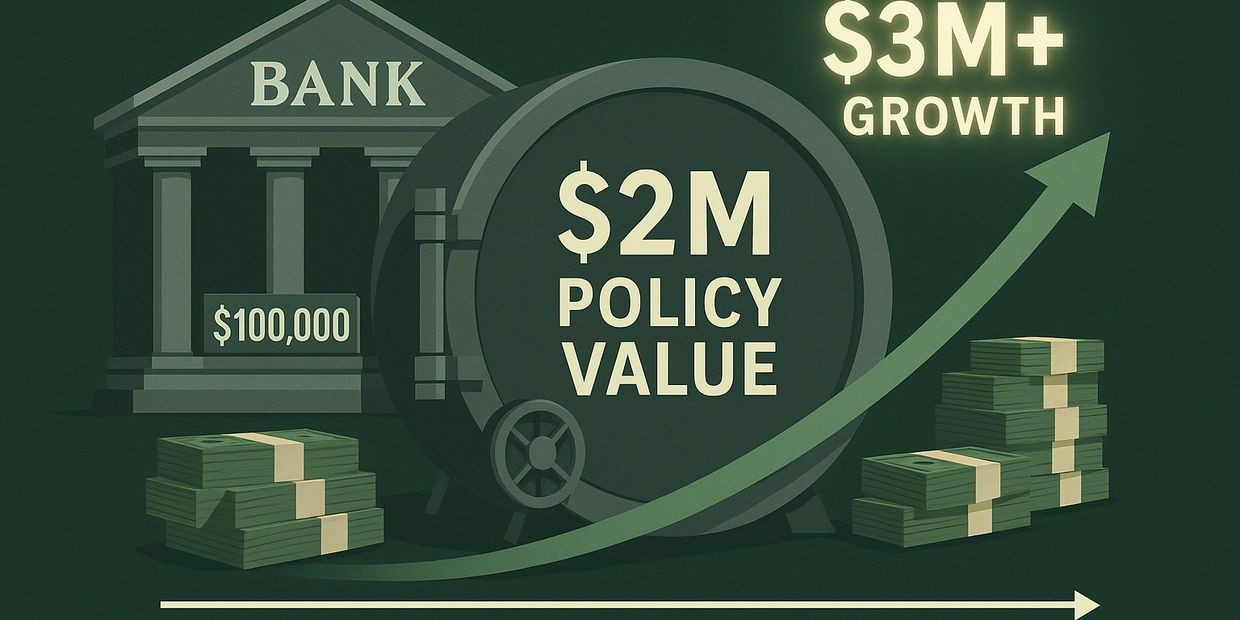

Here’s how it works. Say you have $100,000. You put that into a specially designed life insurance contract that gives you a death benefit, living benefits, and liquid cash value. You use your money to pay the first two years of premiums.

When the third year’s premium comes due, instead of using more of your own money, you go to the bank. You use your policy’s cash value as collateral—something the bank sees as very safe—and they lend you $100,000 at a low interest rate. You use that loan to pay your third-year premium. The next year, you do it again. By repeating this process, you’re using the bank’s money to keep building your account.

Fast forward 20 years. You’ve contributed a total of $2 million into your policy—only $200,000 was your money, and the other $1.8 million came from the bank. Your account is earning returns (say 5%), while the bank charges you a lower interest rate (say 3%). On just the principal, you might earn $100,000 in a year while paying $54,000 in interest—a net gain of $46,000. That’s a 46% return on your $100,000 investment in one year. And that’s before counting the growth your account has built up over the years.

After 20 years, your account could be worth $3 million or more, growing tax-free and compounding year after year. All the while, you’ve only ever put in $200,000 of your own money—everything else was fueled by the bank’s.

TAX_FREE GROWTH!

In this scenario, a generally healthy, non-smoking individual can position themselves to withdraw over $250,000 per year—completely tax free—in retirement. That’s the advantage of building wealth inside a properly structured life insurance contract. As the cash value grows, it compounds tax free, unlike traditional investments that can be eroded by taxes over time. By leveraging this strategy, clients are able to create a powerful stream of retirement income that is protected, predictable, and shielded from the IRS—allowing them to enjoy their wealth without the burden of taxation.

OPM FLex Method

CASE STUDY

Example: A 45-year-old client with $200,000 saved – assuming an 8% return using a traditional investment approach – might expect to receive just under $35,000 in annual income at age 65. The $35,000 is Taxed.

However, with the Flexmethod® strategy, this same $200,000 has the potential to provide this client $136,000 - $186,800 in annual income at age 65. This is over 5x the income of the traditional approach. In the Flexmethod® the $136,000 - $186,800 is TAX FREE.

THe problems with the 401k

are 401ks a good plan?

There is a better way-Retire tax-free!

There is a better way-Retire tax-free!

The first and biggest problem with 401(k)s and other traditional retirement plans is taxes. When you put money into a 401(k), you aren’t avoiding taxes—you’re simply postponing them. And the truth is, no one knows what the tax rate will be in the year you retire. Will it be higher or lower than it is today? Odds are much higher it will be higher. Why? Because taxes are at a historic low compared to where they’ve been since the U.S. first started collecting income taxes, and with growing government debt and spending, the likelihood of higher future tax rates is almost certain. That means every dollar you defer today could be taxed at a much higher rate tomorrow, cutting deep into the nest egg you worked so hard to build. On top of that, 401(k)s are directly tied to the volatility of the stock market. Think back to 2008—people who were ready to retire suddenly saw their accounts cut in half, forcing them to delay retirement for years just to recover. Market “corrections” and crashes happen on average every 9.5 years, meaning your retirement is always at risk of being derailed by the next downturn. And unlike other strategies, with a 401(k) you have little to no control: your money is locked away until you hit retirement age, withdrawals are taxed as ordinary income, and required minimum distributions force you to pull money out even if you don’t want to. In short, traditional retirement plans are a gamble: you’re betting on unknown tax rates, unpredictable markets, and government rules that can change at any time. That’s not security—that’s uncertainty disguised as planning.

There is a better way-Retire tax-free!

There is a better way-Retire tax-free!

There is a better way-Retire tax-free!

Unlike 401(k)s and other traditional plans, our strategy gives you certainty, control, and tax-free growth. Instead of postponing taxes until a future when rates are almost guaranteed to be higher, you build wealth inside a structure where cash value grows tax free and can be accessed tax free in retirement. You’re not at the mercy of Wall Street’s rollercoaster either—your money is protected from market crashes while still compounding year after year. And with full liquidity and flexibility, you control when and how you access your money. Simply put, this strategy delivers what 401(k)s can’t: predictability, protection, and the ability to keep more of what you earn.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.